Roth ira eligibility calculator

Determine your eligibility for a Roth or Traditional IRA. 125000 but 140000.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

A Roth IRA is entirely ineffective if you dont invest the money in your Roth IRA.

. Use this calculator to help you determine whether or not you are eligible to contribute to both the Traditional IRA and Roth IRA and the maximum amount that may be contributed. Ad Contributing to a Traditional IRA Provides for Tax-Deferred Growth. Subtract from the amount in 1.

You can leave amounts in your Roth IRA as long as you live. Here are the income phase-out ranges for taxpayers making contributions to a Roth IRA. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Roth Ira Eligibility Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. Annual IRA Contribution Limit. Up to the limit.

Single head of household or married filing separately and you did not live with your spouse at any time during the year. Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire.

125000 to 140000 Single taxpayers and heads of household. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. While long-term savings in a.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Explore Choices For Your IRA Now. Traditional IRA Calculator can help you decide.

If you earn more than the income cap to. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. 204000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during.

National Life Group is a trade name representing a. IRA Eligibility Calculator Information you provide about your income tax filing status and retirement plan participation will be used to determine your eligibility contribution amount and. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Less than 140000 single filer Less than 208000 joint filer Less than. The Sooner You Invest the More Opportunity Your Money Has To Grow. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022.

Traditional or Rollover Your 401k Today. The IRS regularly adjusts contribution limits and the income caps that determine whether you are eligible to contribute to a Roth IRA. Open a Roth IRA Account.

Comparison Calculator RMD Calculator Estimate your Required Minimum Distributions RMDs for a traditional IRA or an Inherited IRA. Eligible individuals age 50 or older within a particular tax year can make an. You can contribute to a Roth IRA if your Adjusted Gross Income is.

Enter a few step-by-step details Enter a few step-by-step details in our Roth vs. Contributions are made with after-tax dollars. You can make contributions to your Roth IRA after you reach age 70 ½.

Get The Freedom To Plan For Your Income Needs And Legacy Goals. Get Up To 600 When Funding A New IRA. Right here the primary location for financial education Im mosting likely to review 3 of the most effective.

This calculator is designed to help you determine whether you are eligible to contribute to both the Traditional and the Roth IRA. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Get Up To 600 When Funding A New IRA.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. You can adjust that contribution. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the. Find a Dedicated Financial Advisor Now. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

For comparison purposes Roth IRA. Call 866-855-5635 or open a Schwab IRA today. A Traditional IRA Can Be an Effective Retirement Tool.

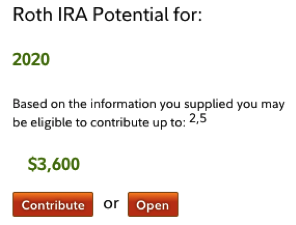

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Invest With Schwab Today. The account or annuity must be designated.

Ad Do Your Investments Align with Your Goals. Ad Open an IRA Explore Roth vs. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Ad Explore Your Choices For Your IRA.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Traditional Vs Roth Ira Calculator

Historical Roth Ira Contribution Limits Since The Beginning

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Best Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator See What You Ll Have Saved Dqydj